Strong Support for Permanent 20% Small Business Tax Deduction

April 8, 2025 - 21:26

As Congress engages in discussions surrounding tax policy, recent insights reveal that a significant number of Americans advocate for the permanence of the 20% Small Business Tax Deduction. This deduction, initially introduced as part of the Tax Cuts and Jobs Act, has been a crucial financial relief for small businesses across the nation.

Advocates argue that maintaining this deduction would provide essential support to small enterprises, which are vital to the economy and job creation. Many small business owners have expressed that the deduction has positively impacted their operations, allowing them to reinvest in their businesses, hire new employees, and enhance their services.

The National Federation of Independent Business (NFIB) in Minnesota emphasizes the importance of this tax relief, highlighting that a stable tax environment is crucial for the growth and sustainability of small businesses. As the debate continues, the call for making the 20% Small Business Tax Deduction permanent resonates strongly among entrepreneurs and community leaders alike.

MORE NEWS

February 24, 2026 - 21:58

Mpls Fed survey: Upper Midwest businesses report falling profits, tariff uncertaintyA recent survey conducted by the Federal Reserve Bank of Minneapolis reveals a concerning trend of falling profits across the Ninth District, which encompasses the Upper Midwest. Businesses from...

February 24, 2026 - 05:04

Widespread boil water advisory prompts businesses to closeA major boil water advisory has swept through the city, leading to the immediate closure of numerous restaurants, cafes, and other businesses reliant on safe tap water. City officials confirmed the...

February 23, 2026 - 18:50

NYC mayor threatens property tax hike, raising concerns for businessesA proposed property tax hike from New York City`s mayor is generating significant concern among the city`s business community. The initiative, aimed at addressing a substantial budget shortfall,...

February 23, 2026 - 12:25

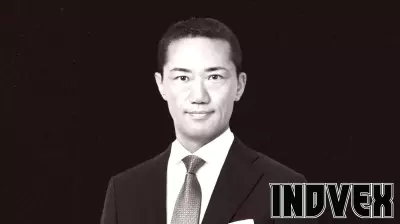

Media Buying Briefing: Dentsu’s new CEO on how he’s going to grow the business againTakeshi Sano has assumed the role of global CEO at Dentsu, signaling a strategic shift for the advertising holding company. Sano brings a distinctly more outgoing and worldly approach to leadership...